An investment vehicle structured as a loan that will convert to equity in a future round. Web with a convertible note agreement, you can legally convert debts into shares of the company. Startups rarely qualify for traditional debt financing from. Generally, convertible debt facilitates capital investments from friends and family, incubators, angel groups, seed funds, some venture capital funds, and more. Easily customize your loan agreement.

A convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Real estate, family law, estate planning, business forms and power of attorney forms. Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their. Easily customize your loan agreement. Ad get access to the largest online library of legal forms for any state.

Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their. The investor loans money for the startup. It starts off as a loan (debt), but the lender and the. Such a tool allows for raising funds without. Web this convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of.

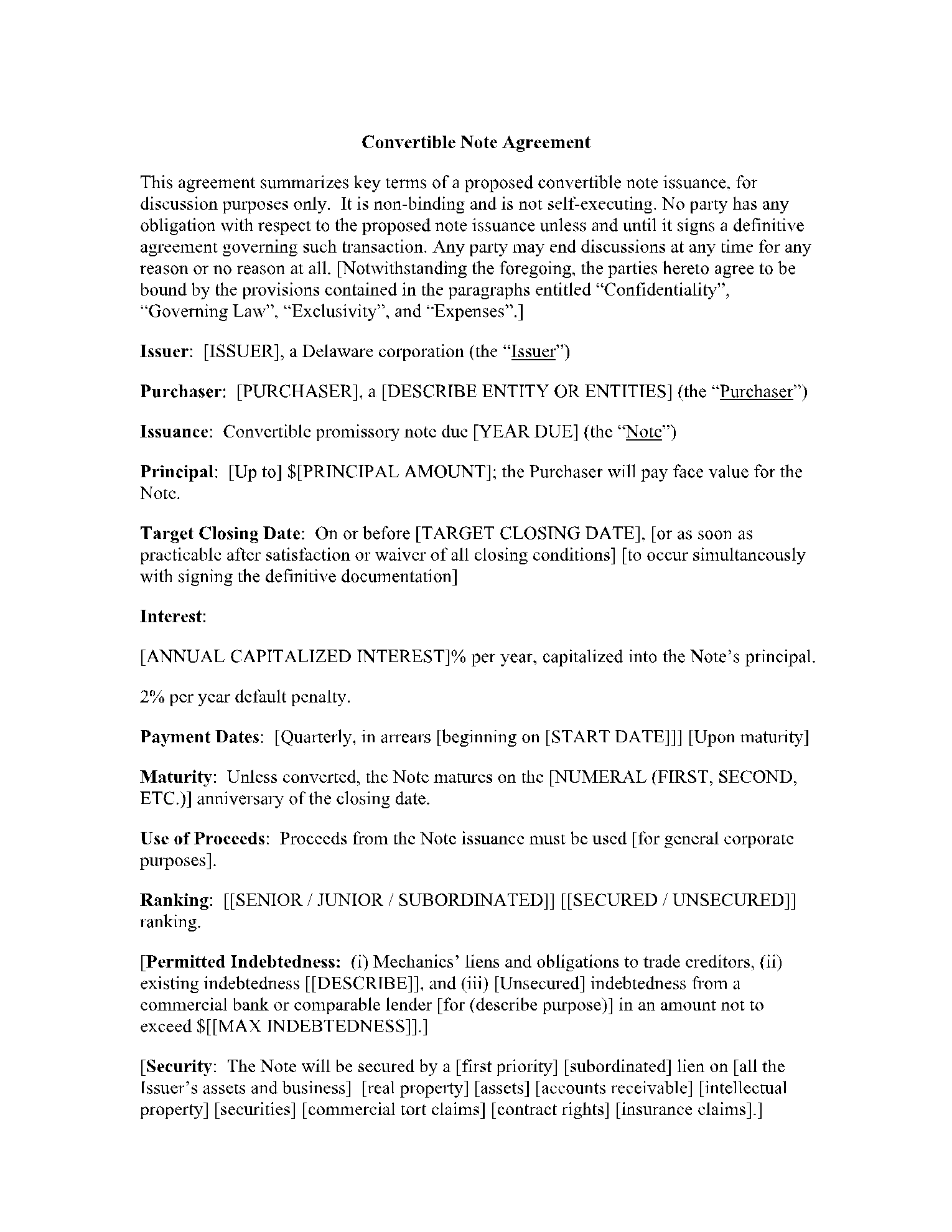

Ad get powerful, streamlined insights into your company’s finances. Web a convertible debt note sample is a crossover of both equity and debt. Real estate, family law, estate planning, business forms and power of attorney forms. It starts off as a loan (debt), but the lender and the. It’s a common way for investors to invest in early stage startups, particularly. Such a tool allows for raising funds without. Web a convertible note is a loan from the investor to the company that converts to stock upon preferred stock financing that meets certain conditions. Our legally binding convertible note agreement sample helps you identify all. Web a convertible note agreement is a document that describes the conditions under which a company or a person lends money to another company but that debt can be converted. Web convertible notes, also known as convertible promissory notes or convertible debt, are a type of debt instrument commonly used by startups to secure financing during their. An investment vehicle structured as a loan that will convert to equity in a future round. Generally, convertible debt facilitates capital investments from friends and family, incubators, angel groups, seed funds, some venture capital funds, and more. Web with a convertible note agreement, you can legally convert debts into shares of the company. A convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. Web this convertible promissory note (note) has been acquired by the investor solely for its own account for the purpose of.

![Convertible Note Agreement Template [Free PDF] Google Docs, Word](https://i2.wp.com/images.template.net/9940/Convertible-Note-Agreement-Template.jpeg)