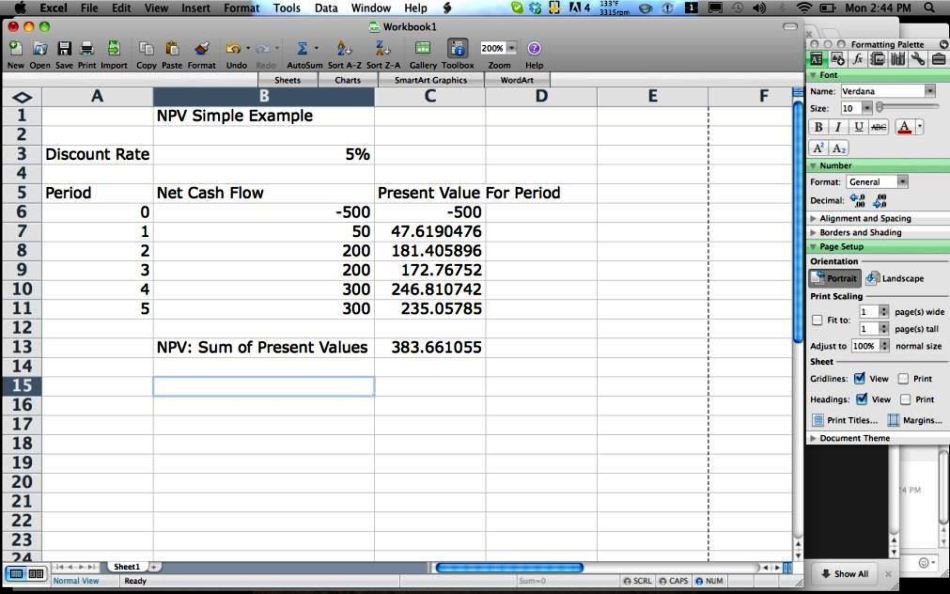

The present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now. You can use pv with either periodic, constant. Net present value is the difference between pv of cash flows and pv of cash outflows. The first worksheet is used to calculate present value based on interest rate, period and yearly payment. Web calculating present value.

Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. In doing so, you can calculate. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). It is used to determine the. The present value (pv) is an estimation of how much a future cash flow (or stream of cash flows) is worth right now.

Grab exciting offers and discounts on an array of products from popular brands. Web calculating present value. Present value of a single cash flow. Ad are you ready to become a spreadsheet pro? Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows.

Present value is discounted future cash flows. Ad we offer an extensive selection of office calculators at great prices. Web present value calculator itself will help you to calculate the exact value of the future investment as if it existed in the present day. Web the net present value (npv) of an investment is the present value of its future cash inflows minus the present value of the cash outflows. The big difference between pv and npv is that npv takes into account the initial investment. In doing so, you can calculate. Web how to calculate present value in excel. It calculates the present value of a loan or an investment. Goskills ms excel course helps your learn spreadsheet with short easy to digest lessons. Web calculating present value. Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Web this present value or pv calculator consist of three worksheets. While you can calculate pv in excel, you can also calculate net present value(npv). Grab exciting offers and discounts on an array of products from popular brands.