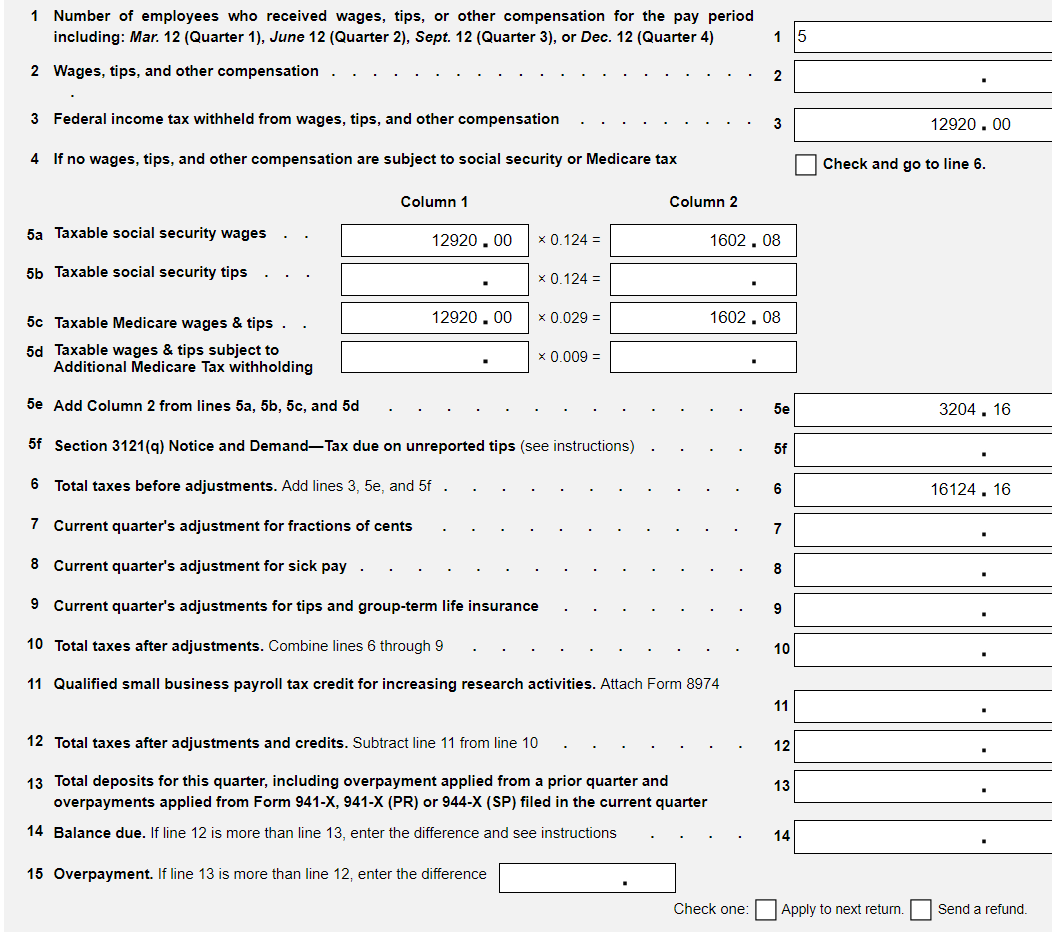

Web form 941 for 2021: Check the box on line 16, and enter the date final wages were paid indicating that your business has closed and that you do not need to file returns in. Under forms, click the quarterly forms link. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. This form is for income earned in tax year 2022, with.

Web up to 25% cash back this form must be filed by the 15th day of the fourth month after you close your business. Form 941, employer's quarterly federal tax return: Web choose setup > clients and click the payroll taxes tab. Web your total taxes after adjustments and credits (form 941, line 12) for either the current quarter or the preceding quarter are less than $2,500, you didn't incur a $100,000 next. Web print the federal form 941.

We last updated federal form 941 in july 2022 from the federal internal revenue service. Form 941 is used by employers. Choose the payroll tax tab. Filing deadlines are in april, july, october and january. Under forms, click the quarterly forms link.

Form 941, employer's quarterly federal tax return: March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121. Under forms, click the quarterly forms link. Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Form 941 is used by employers. There are two ways to generate the form. Corporations also need to file irs form 966, corporate dissolution or. Web this pdf is the current document as it appeared on public inspection on 09/13/2023 at 8:45 am. Web more about the federal form 941. In the forms section, click the additional information button for the federal 94x form. Web up to $32 cash back instructions for filling out revised form 941. You must file a final return for the year you close your business. Click the final statement button. Choose the payroll tax tab.